In today’s competitive restaurant landscape, effective pricing strategy can make the difference between thriving and merely surviving. While food quality and service excellence remain essential, how you price your menu items often has a more profound impact on your bottom line than any other single factor. Yet many restaurant operators continue to make critical pricing mistakes that erode profitability and leave significant revenue on the table. This article examines the five most damaging pricing errors restaurants commit and provides practical, actionable solutions to transform your approach.

From becoming trapped at specific price points to relying on outdated cost-plus models, these common pitfalls undermine restaurant profitability in subtle but powerful ways. By understanding and addressing these mistakes, you’ll develop a more sophisticated pricing strategy that enhances margins while maintaining—or even improving—guest satisfaction and loyalty.

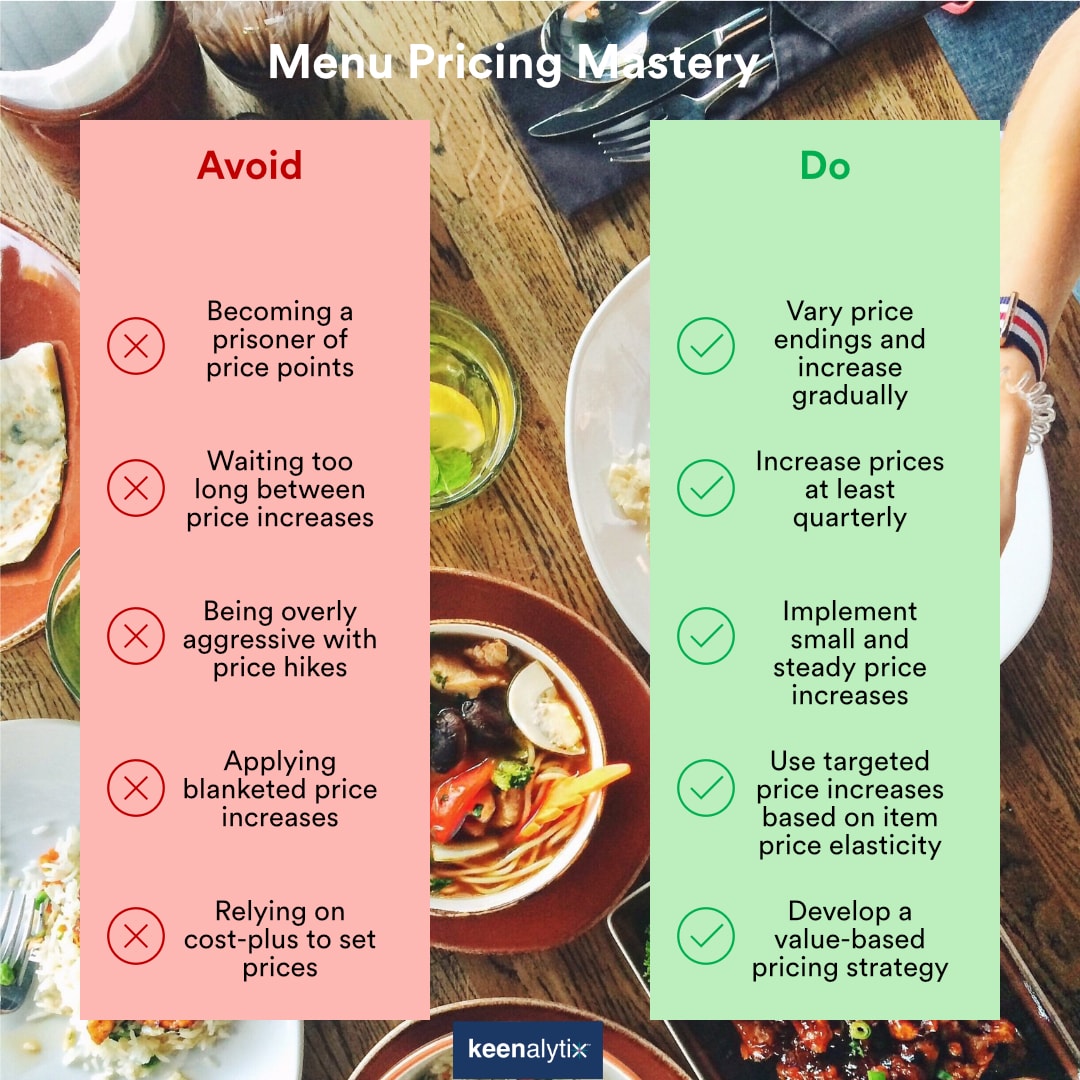

Mistake #1: Becoming prisoner of a price point

I once had a client who had been running the same “2 for $1” deal for over 30 years. Less extreme, but just as damaging, are the countless situations in which items get “stuck” at $2.99 or $3.99 for fear of crossing a dreaded price threshold.

Let’s be clear: price thresholds are not a myth, and price points can effectively drive sales when used properly. Yes, you will likely lose volume when you cross a threshold. However, they become problematic when they dictate your entire menu pricing strategy.

What to do about it?

Ensure you use multiple price endings across your menu. If all your prices end in .99, each increase becomes a threshold-crossing exercise that inevitably leads to lost volume. On the other hand, if only 10-15% of your menu sits at such price endings at any given time (ideally balanced across your menu, not concentrated on top-selling items), you significantly minimize your risk exposure.

If too many items sit at critical price thresholds, start taking price on lower-volume items to minimize the impact on your top and bottom line, then work your way up the list, one quarter at a time. The good news: you can move directly to the next ending in .19 (e.g., from $2.99 to $3.19, not $3.09). Extensive evidence shows a “zone of indifference” between prices ending in .09 and those ending in .19.

Mistake #2: Waiting too long between price increases

The days of taking a single, annual price increase are over—and for good reason. Those approaches were suboptimal because they forced brands to leave items at the same price point for too long without flexibility to adapt to fast-changing environments (new competitors, minimum wage changes, etc.).

What to do about it?

In QSR and Fast Casual, almost all brands now use digital menu boards, eliminating excuses for infrequent price adjustments. Four small quarterly increases per year should be your minimum; some brands have already moved to a monthly cadence.

This approach offers multiple advantages. First, small price increases are less “visible” than larger ones, minimizing observed price elasticity and adverse volume impact. Second, you can synchronize increases with each item’s seasonality: taking price on an item during its low season (e.g., cold beverages in winter) minimizes volume impact. Third, it prevents items from getting stuck at a given price point by ensuring adjustments every 12-18 months.

Mistake #3: Being too aggressive

In pricing, as in life, slow and steady wins the race. Some brands defy this maxim through overly aggressive price increases, securing short-term margin boosts but eventually suffering more damaging hits to guest count and volume. Many brands made this mistake during the recent high-inflation period and lost significant market share as a result.

What to do about it?

Small, quarterly price increases, strategically implemented across multiple menu categories and leveraging item seasonality, drive revenue and margins more effectively than one-time “giant” price hikes. Remember the compounding effect: a dime at a time, with virtually no impact on volume, significantly drives margins over time.

Mistake #4: Using the “3% across the (menu) board” approach

Let’s be unequivocal: blanketed price increases do not work. The typical price realization on a 3% across-the-board increase approaches only 1%, which forces brands to push more aggressive increases to reach their targets. This is the fastest route to losing volume, guest count, and ultimately revenue and margin.

What to do about it?

Targeted price increases drive price realization and financial results far more effectively. Begin by analyzing each menu item’s price elasticity to determine which are highly price-sensitive (poor candidates for increases) and which are price-insensitive.

Price elasticity alone shouldn’t dictate your decisions. Timing should also consider factors like seasonality, time elapsed since the previous increase, and the competitive environment for each specific item. Nevertheless, price elasticity provides an excellent starting point for targeted price increase strategies.

Mistake #5: Using cost-plus

A casual dining client once proudly showed me their “beautiful” pricing strategy: group items by menu category, set a target margin for each category, determine food and labor costs for each item—and voila! While impressive on spreadsheets, it ignored one fundamental truth: guests care nothing about your costs.

What to do about it?

To be clear, costs should remain a consideration when setting prices—profitability requirements never disappear. However, costs should establish the floor for your prices, not determine the prices themselves.

Actual prices should reflect multiple factors that comprise your pricing strategy (and no, cost-plus is not a “strategy” but merely an accounting exercise): the perceived value of each item, its price elasticity, and its competitive positioning.

Conclusion

Successful restaurant brands combine all elements discussed above:

A value-based pricing strategy that incorporates guest perception, competitive environment, and item price sensitivity.

Small, regular, and highly targeted price increases driven by item price elasticity, seasonality, and timing.